Understanding the “Texas Two-Step” Bankruptcy Procedure

The ”Texas Two-Step” bankruptcy procedure has made headlines in recent years, particularly for its use by large corporations facing significant financial liabilities. Known for its unique legal maneuvering, this strategy allows companies to potentially avoid substantial financial burdens, sometimes at the expense of those seeking compensation through lawsuits. In this article, we will break down the basics of the “Texas Two-Step,” its purpose, and the implications it may have for creditors and claimants in mass tort cases.

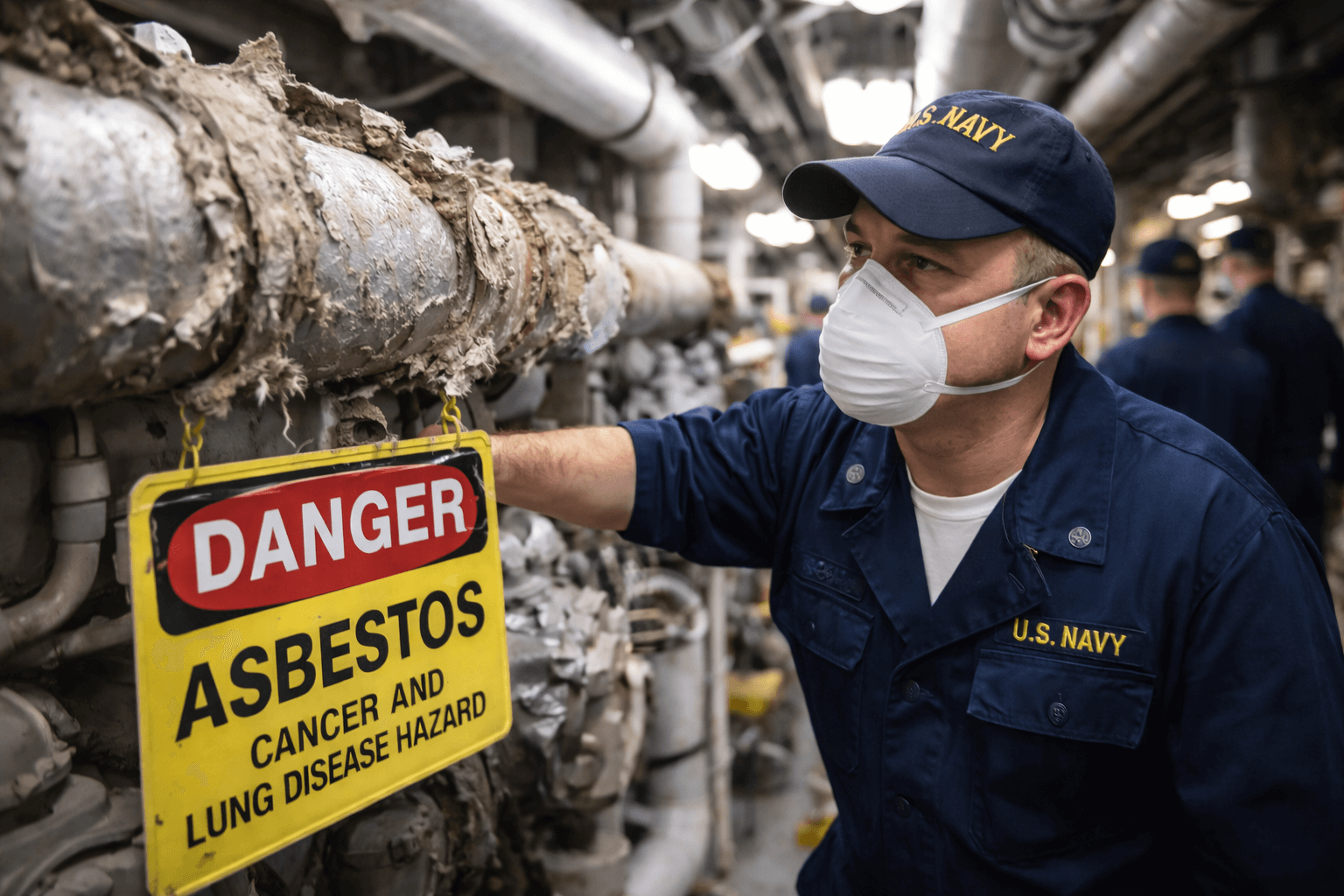

Anyone who has questions about the State of Texas bankruptcy process and how it could apply to their claim should call Flint Cooper. Flint Cooper’s experienced attorneys are here to help. Our firm has been advocating for clients’ rights for over 30 years, winning over $17 billion for our clients in asbestos-related litigation.

A Quick Overview of Bankruptcy

Before diving into the specifics of the “Texas Two-Step,” it is helpful to understand some basics of bankruptcy law, especially the two types most relevant to corporations:

- Chapter 7 Bankruptcy: Known as “liquidation” bankruptcy, Chapter 7 involves the sale of assets to pay creditors. While some property may be exempt, filers can generally expect to lose a substantial portion of their assets.

- Chapter 11 Bankruptcy: Often referred to as “reorganization” bankruptcy, Chapter 11 allows businesses to continue operating while they restructure their finances. When a business files for Chapter 11, a temporary stay is placed on creditors’ claims, giving the business breathing room to formulate a repayment plan.

The “Texas Two-Step” bankruptcy procedure leverages Chapter 11’s reorganization structure but does so in a way that divides liabilities and assets between newly formed entities. This approach has raised questions about fairness and transparency, particularly among creditors.

What is the “Texas Two-Step”?

The “Texas Two-Step” is a legal strategy made possible by Texas’s unique corporate laws. In essence, it allows a company to split into two separate entities, a process known as a “divisive merger.” Under Section 1.002(55)(A) of the Texas Business Organizations Code (TBOC), a divisive merger lets a single business divide itself into two or more new entities, with each inheriting a portion of the original company’s assets and liabilities.

Here is how it typically works:

- Divisive Merger: The company divides itself into two entities, one that holds the assets and one that holds the liabilities.

- Bankruptcy Filing: The entity burdened with the liabilities files for Chapter 11 bankruptcy. This shields the asset-holding entity from bankruptcy pressures, allowing it to continue operating without disruption.

This maneuver, when used by companies facing mass tort lawsuits, can allow them to separate their operational assets from their financial obligations to claimants. In theory, the “Texas Two-Step” enables companies to restructure while maintaining financial stability. However, critics argue that it unfairly protects corporate assets from claimants who may be seeking compensation for harm.

- The Johnson & Johnson Case: A Notable Example: One of the most high-profile examples of the “Texas Two-Step” in action involved Johnson & Johnson. Facing thousands of lawsuits related to talc in its baby powder products, Johnson & Johnson executed a divisive merger, transferring its liabilities to a new entity, LTL Management, LLC (LTL). LTL then filed for Chapter 11 bankruptcy, effectively isolating Johnson & Johnson’s main operations from the financial impact of the lawsuits.

Claimants argued that Johnson & Johnson was not in genuine financial distress and that the “Texas Two-Step” bankruptcy filing was intended to delay or deny justice for plaintiffs. In 2023, the Third Circuit Court of Appeals ruled against Johnson & Johnson, stating that the bankruptcy did not serve a legitimate bankruptcy purpose due to the lack of financial hardship. This decision underscored the challenges companies may face when attempting to use the “Texas Two-Step” strategy in court, particularly when plaintiffs challenge the legitimacy of the bankruptcy. - The Debate: Shielding Assets vs. Fair Compensation: While the “Texas Two-Step” may offer financial relief for companies, it is a controversial strategy. Critics argue that it allows companies to sidestep accountability by placing their liabilities out of reach of claimants. Proponents, however, believe it provides a pathway for companies to remain viable while addressing their debts.

Courts are increasingly scrutinizing the use of divisive mergers in bankruptcy cases, especially when the strategy appears to limit claimants’ ability to recover compensation. The “Texas Two-Step’s” future remains uncertain as courts and lawmakers debate its impact on corporate accountability and creditor rights.

How Flint Cooper Can Help

If you are concerned about how the “Texas Two-Step” bankruptcy procedure might impact your ability to recover compensation, Flint Cooper’s skilled attorneys are here to guide you. With over 30 years of experience and a proven track record, we understand the complexities of bankruptcy law and are prepared to fight for fair outcomes. To schedule a consultation, contact us online or by phone today.

About the author:

Trent Miracle

Trent is a partner and managing member of Flint Cooper’s mass torts practice, where he and his experienced team of professionals litigate the firm’s mass tort cases, as well as manage the strategic direction of the practice. With more than 25 years of experience, Trent is a nationally recognized attorney who represents individuals harmed by dangerous drugs and defective medical devices. Over the course of his career, he has helped recover more than $2 billion in settlements for clients injured by products made by pharmaceutical giants like Johnson & Johnson, AbbVie and Bayer. Trent has held court-appointed leadership roles in numerous high-profile multidistrict litigations, including serving as co-lead counsel in the Suboxone, Tepezza and testosterone therapy MDLs.